advantages and disadvantages of llc for rental property

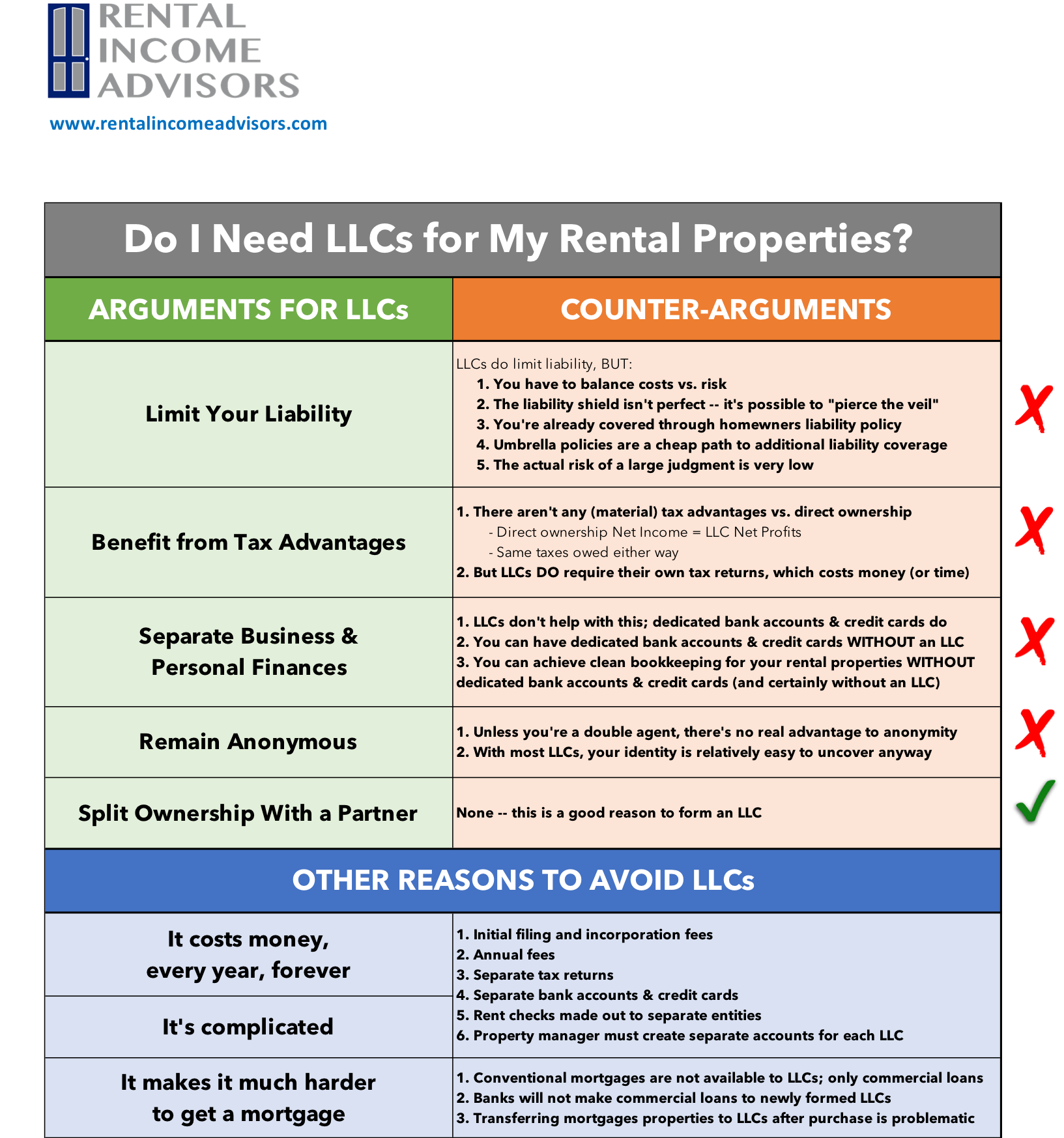

While LLCs have many benefits they also come with some drawbacks. The LLC owner will likely have to foreign qualify the LLC in Ohio because thats where the business of renting the property is being conducted.

Llc For Rental Property Benefits And Disadvantages Honeycomb

If your LLC is named in a lawsuit involving your property the.

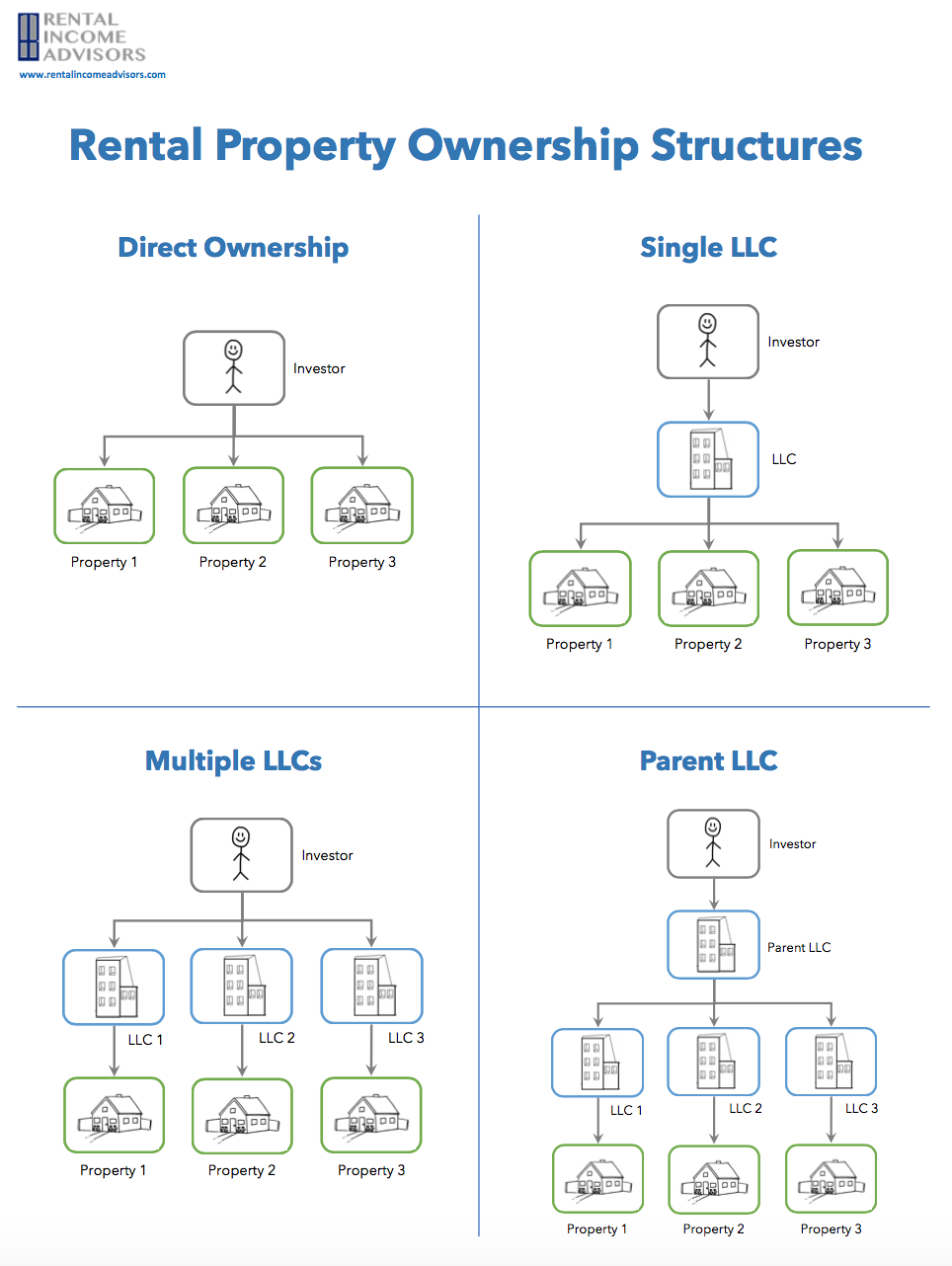

. A limited liability company is better for asset protection and can separate your rental debts from your liabilities. Three advantages to using an LLC for rental property. With any real estate investment a real estate investor is taking on risk.

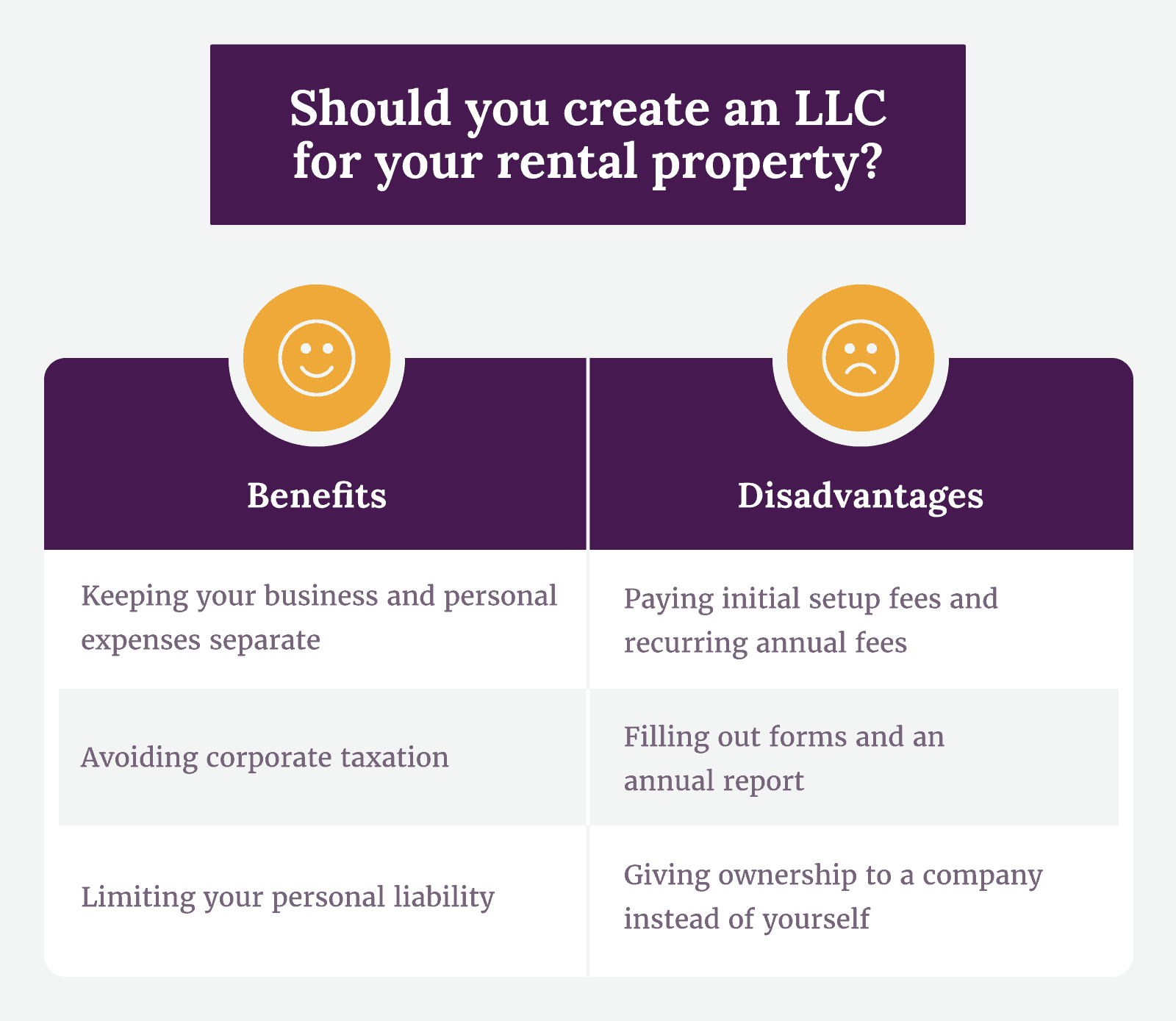

If rental properties are part of your investment portfolio then. There are limits to the protections an LLC provides. Upfront Costs One of the major disadvantages of setting up an LLC for rental property is the upfront costs.

Disadvantages of Forming an LLC. Using an LLC to own your property rental business has key advantages when it comes to liability protection insulating your assets and ownership flexibility. The drawbacks of having rental properties include a lack of liquidity the cost of upkeep and the potential for difficult tenants and for the neighborhoods appeal to decline.

Here are the three potential drawbacks of this solution. One of the disadvantages of using an LLC for a real estate rental. Lets cover the first most obvious advantage of a real estate LLC.

Advantages of a Series LLC for Real Estate Investments. In fact some real estate companies put each rental property in its own LLC as a subsidiary of the parent company. List of the Cons of Using an LLC for a Rental Property 1.

There are many advantages to establishing an LLC for your rental properties. Lets turn to the potential disadvantages of forming an LLC. Using a limited liability company to protect your rental properties has many advantages but a few disadvantages too.

The advantages are the limited liability the nontaxable status of the LLC and. Depending on your specific situation and unique circumstances the following may be considered pros for. LLCs offer several tax benefits for rental property with set expenses that can be deducted and ways to minimize total payable tax costs.

Disadvantages of Creating an LLC for Rental Property 1. Keeping your business and personal. A Tangible Personal Property Tax is levied against businesses and rental properties and it is an ad valorem tax levied against furniture fixtures and equipment.

It Costs Money to Register an LLC for Single Family Rental Properties The aforementioned benefits come at a cost. The key disadvantages relate to. So Ohios laws and tax rules.

Limited liability for real estate investors. Much like starting an LLC for any other company there are financial and legal benefits to running your rental property under an LLC. LLCs are able to utilize pass-through.

The advantages and disadvantages to owning rental property in an LLC Real estate investors -just like every business owner- need to track their income and expenses so. Here are some of the reasons certain investors and landlords choose to stay. Drawbacks of an LLC for Rental Properties While there are many benefits to creating an LLC there are also quite a few drawbacks that make it a less advantageous option.

Llc For Rental Property Real Estate Llc Truic

Advantages And Disadvantages Of Limited Liability Company

The Advantages And Disadvantages To Owning Rental Property In An Llc Rei Hub

A Know It All Facts In Becoming An Llc Davis Property Management Seattle Everett Bellevue

Creating Llc For Rental Property Ny Rent Own Sell

What Is The Most Advantageous Business Entity For Real Estate Investors To Form Kendall Law

Can My Llc Buy My House Fibyrei

Should You Create An Llc For A Rental Property Youtube

Llc For Rental Property All Benefits Drawbacks Alternatives

The Pros And Cons Of Property Management Company

Llc For Rental Property Pros Cons Explained Simplifyllc

Llc For Rental Property Pros Cons Explained Simplifyllc

28 Forming An Llc For Your Rental Properties Passive Income

Why Depreciation Matters For Rental Property Owners At Tax Time Stessa

The Pros And Cons Of Putting Rental Property In An Llc Kmsd Law Office

Rental Property Llc Tax Benefits Pros Cons Of Using An Llc For Real Estate Youtube

Why You Probably Don T Need An Llc For Your Rental Properties Rental Income Advisors

Advantages And Disadvantages Of An Llc For Rental Property

Creating An Llc For Single Family Rental Properties Advantages Disadvantages